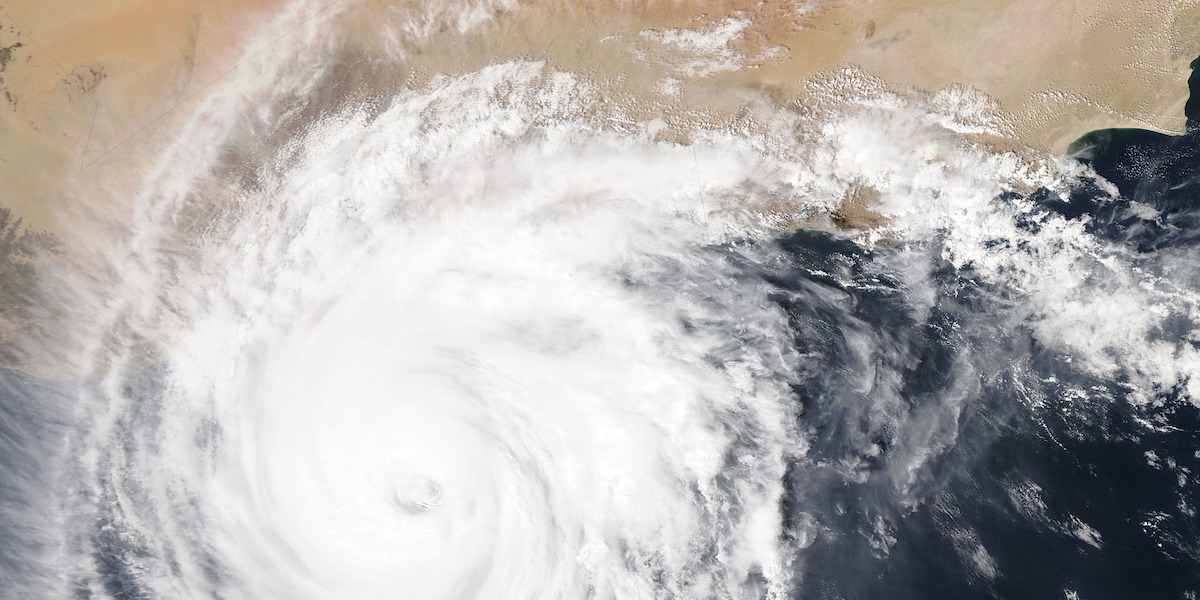

Hurricane Bonnie is one of the many possible hurricanes that may make landfall in Florida this hurricane season. If you are affected by this hurricane, you might be eligible for financial assistance for a range of things, including home repairs, temporary housing, and more. This is a guide on what to do after any hurricane that impacts you.

The first step is to file a claim with your insurance company.

How To File Your Hurricane Insurance Claim

If you have hurricane insurance, you should file a claim as soon as possible after the storm has passed. Your insurer will likely have an adjuster contact you to assess the damage to your home or business.

Be prepared to provide documentation of the damage, such as photos or videos. Along with photos and videos, it is extremely important to add notations with any piece of documentation that will help the adjuster understand what they are looking at. It will give you something to refer back to as your memory fades and the details become less clear.

If you have any damage that is not covered by your insurance policy, you may still be eligible for assistance from FEMA or other government agencies. However, you will need to provide documentation of the damage to apply for this assistance and will need to ensure that you are actually eligible to begin with. This is another reason why working with a hurricane claims attorney can be beneficial, as they can help you with the application process and make sure that you have everything you need — and even identify different benefits or programs that you may be eligible for that you weren’t aware of.

Keep any receipts for temporary repairs you make to prevent further damage, as you may be reimbursed for these expenses depending on what your insurance policy and riders cover.

If your home is uninhabitable, you may be eligible for additional living expenses, such as hotel costs or rental assistance. These expenses must be verified and documented, so keep all of your receipts and stay in contact with your insurance adjuster as you move forward.

Different agencies have different deadlines for applying for assistance, so it is important to act quickly.

The Importance of Working With an Attorney

If your insurance claim gets denied, or if you feel that the insurance company is not offering you a fair settlement, you may want to consider hiring a hurricane claims attorney. An attorney will be able to review your policy, help you understand your coverage, and represent you in negotiations with the insurance company.

An attorney can also help if your claim has been delayed or if the insurance company has requested more information than you are able to provide. In some cases, an attorney may even be able to help you file a lawsuit against your insurance company if necessary.

No one should have to go through the process of filing a hurricane insurance claim alone, and an experienced attorney can be a valuable ally. They will ensure that you are treated fairly by your insurance company and receive the full compensation you are entitled to.

Contact CarAccidentAttorney.com Today

Trying to get the money you deserve after a hurricane can be daunting, but being well prepared and organized will help you immensely. If you have any questions or need assistance with your claim, CarAccidentAttorney.com can connect you with an attorney in your area who will help you make sense of your situation, file a claim, and fight to ensure that you get the compensation you deserve. CarAccidentAttorney.com is an attorney and medical referral service.

And finally, remember that you are not alone in this – many people across Florida and the Gulf Coast are going through similar issues.

If you have questions about your hurricane insurance policy or filing a claim, contact your agent or insurer for answers.