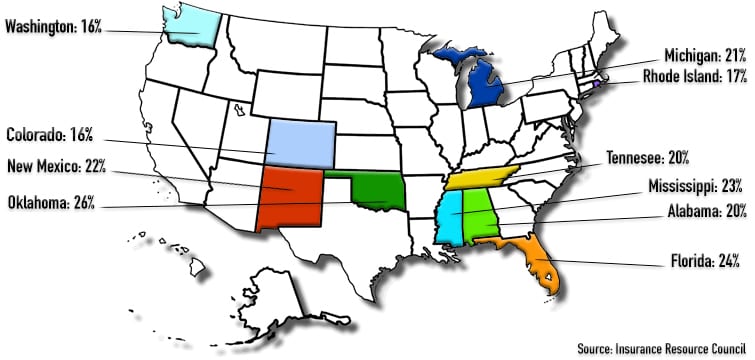

Uninsured/Under-insured coverage is additional insurance coverage meant to protect you if the at-fault driver has no insurance or is under-insured and cannot pay your outstanding bills. This coverage is also highly beneficial in the case of hit-and-run accidents.If your PIP coverage is exhausted and your bills soar because you need additional medical attention, who is going to pay? It is highly recommended that drivers add under-insured and uninsured motorist coverage to their policy. We have put together a map using the 2016 statistics from the Insurance Research Council that shows which states have the highest rate of drivers without insurance- and that puts other drivers at risk. In the United States, it is estimated that a total of 30 million drivers are uninsured; that’s about 12.6% of drivers nationwide.

Drivers in these states have a higher risk of getting stuck with out-of-pocket costs in the post-accident process. It is essential to consider what to add to your coverage so you are fully protected in case of an automobile accident and can recover all your losses regardless of whether the other parties involved have insurance or not.

Uninsured and Under-Insured Coverage in Florida

Uninsured Motorist (UM) Coverage in Florida

Uninsured Motorist coverage in Florida provides financial protection to drivers and passengers injured in an accident caused by a driver who lacks liability insurance. Given that Florida has one of the highest rates of uninsured drivers, UM coverage is helpful to ensure that medical expenses, lost wages, and other damages are covered if the at-fault driver is uninsured.

Since Florida is a no-fault state, each driver’s Personal Injury Protection (PIP) insurance is initially responsible for covering immediate medical expenses. Still, PIP has limits, typically only covering 80% of medical bills and 60% of lost wages, capped at $10,000. When injuries are severe, UM coverage becomes essential for protecting policyholders from significant out-of-pocket expenses.

Under-Insured Motorist (UIM) Coverage in Florida

FL under-insured Motorist coverage helps cover damages when an at-fault driver’s liability insurance is insufficient to compensate the injured party fully. Florida’s state-mandated minimum liability insurance requirement is only $10,000 per person and $20,000 per accident for bodily injury, an amount often far too low to cover costs resulting from serious accidents.

UIM coverage provides additional protection under Florida law, covering the gap between the at-fault driver’s liability limits and the actual damages incurred by the injured party. Like UM coverage, UIM can help policyholders avoid financial strain if they are involved in a serious auto accident with an underinsured driver.

Distinctions Between Uninsured and Under-Insured Coverage in Florida

While Uninsured Motorist and underinsured motorist coverages share similarities, their roles in claim protection against an uninsured or underinsured driver are distinct under Florida insurance coverage laws.

Uninsured Motorist vs. Under-Insured Motorist Protection

UM coverage applies strictly to accidents where the at-fault driver has no insurance at all. In contrast, UIM coverage comes into play when the at-fault driver has insurance, but their coverage limits are insufficient to cover all the damages. For example, if an at-fault driver has zero insurance coverage, the uninsured motorist claim would cover the injured party’s medical and other accident-related expenses. If the at-fault driver carries insurance but only has minimal coverage that does not cover the total costs, underinsured motorist coverage fills the gap.

Stacked vs. Non-Stacked UM/UIM Coverage Options

Florida allows policyholders to select between “stacked” and “non-stacked” UM/UIM coverage. Stacked coverage enables the policyholder to combine the UM/UIM limits across multiple vehicles in their household, increasing the total protection. Non-stacked coverage, typically less expensive, limits coverage to a single vehicle’s UM/UIM limits, which may be more restrictive but also cost-effective for policyholders with fewer vehicles.

Benefits of Uninsured and Under-Insured Coverage in Florida

Extended Financial Protection in Accidents

One of the most significant benefits of UM/UIM coverage is the financial security it offers. Medical costs can add up quickly following a car accident, especially if hospitalization, surgery, or long-term rehabilitation is needed. Purchasing uninsured motorist coverage and UIM coverage helps provide compensation beyond the limits of standard PIP insurance and the at-fault driver’s bodily injury liability coverage limits, ensuring that policyholders can recover without incurring overwhelming expenses.

Coverage for Non-Economic Damages

Unlike PIP coverage, which only applies to economic damages such as medical bills and lost wages, UM and UIM coverage can also provide compensation for non-economic damages like pain and suffering, mental anguish, and loss of quality of life. This extended coverage is beneficial in serious accidents where the victim’s life is significantly altered, helping alleviate financial burdens related to reduced quality of life.

Protecting Passengers and Household Members

UM/UIM coverage generally extends to passengers in the policyholder’s vehicle, as well as family members or residents of the policyholder’s household. When you purchase uninsured motorist coverage and UIM coverage, it can offer peace of mind, knowing that others in the vehicle or family members involved in a motor vehicle accident may be protected by the policy, even if they are not directly named.

Mitigating the Risk of High Out-of-Pocket Expenses

In cases where the at-fault driver has no or minimal coverage, the injured party might face extensive out-of-pocket costs without UM/UIM coverage. This insurance reduces the risk of substantial financial burdens, as it provides additional protection for the injured party’s medical expenses and other accident-related losses in a car accident claim.

Common Misconceptions About Florida Uninsured and Under-Insured Coverage

- Misconception # 1: UM/UIM Coverage Is Too Expensive: While UM/UIM coverage does add an extra cost to a policy, it is typically affordable compared to the potential financial risks of an uninsured or underinsured accident. Many policyholders find the additional premium to be a valuable investment for peace of mind and long-term protection against an accident with an uninsured or under-insured motorist.

- Misconception # 2: PIP Insurance Alone Is Sufficient: Some drivers assume that PIP insurance provides comprehensive accident protection, but PIP has its limits and only covers a portion of medical expenses and lost wages. Uninsured motorist insurance and UIM coverage offer critical additional protection, especially against severe injuries, pain, and suffering in an uninsured motorist accident or cases where PIP benefits have been exhausted.

- Misconception # 3: Health Insurance Will Cover Accident Costs: Health insurance may cover certain medical expenses, but it often does not cover lost wages, non-economic damages, or other out-of-pocket costs related to car accidents. UM/UIM coverage under Florida personal injury law can provide compensation for these broader costs, offering more complete coverage in the event of an accident with an under-insured or uninsured driver.

How to Choose the Right Uninsured and Under-Insured Coverage in Florida

- Assess Your Risk Factors: When selecting UM/UIM coverage, consider personal risk factors such as driving frequency, health status, and financial readiness for unexpected costs. Individuals who drive frequently or in high-traffic areas may find higher coverage limits beneficial, as increased exposure to the risk of uninsured or underinsured accidents warrants a stronger safety net.

- Decide Between Stacked and Non-Stacked Coverage: Stacked coverage can offer higher protection but may also increase premiums. For policyholders with multiple vehicles or high-risk factors, stacked coverage might be worth the investment, as it allows for combining limits across all cars in the household. Non-stacked coverage is generally less expensive and may suit those who drive fewer miles or have only one vehicle.

- Understand Policy Limits and Coverage Gaps: A careful review and understanding of policy limits is vital for selecting the appropriate level of UM/UIM coverage. Many insurers offer UM/UIM limits that mirror the policyholder’s bodily injury liability limits, which can help prevent gaps in coverage. Choosing limits that cover possible scenarios, especially given the low minimum insurance requirements in Florida, can be an intelligent way to avoid significant out-of-pocket expenses.

- Consult with a Car Accident Attorney: Working with a car accident lawyer can provide valuable insight into the suitable UM/UIM options based on individual needs, budget, and coverage goals. A knowledgeable insurance agent can also help navigate Florida’s insurance landscape, ensuring that policyholders make informed decisions and secure adequate protection in the event of an accident.

Steps to File Your UM/UIM Insurance Claim in Florida

- Report the accident to your insurer immediately, providing details like the location, time, and contact information of the underinsured or uninsured motorists involved.

- Gather supporting evidence, including the police report, medical records, and photos of the accident scene.

- Notify your insurance company in writing that you are filing a UM/UIM claim due to the at-fault driver’s lack of adequate insurance.

- Work with the claims adjuster assigned to your case, who will review your documentation and assess damages.

- Get legal representation from Florida personal injury lawyers if needed to help negotiate a fair settlement and ensure your claim is processed smoothly and efficiently.

Contact CarAccidentAttorney.com – a Law Firm Directory

If you or a loved one has been involved in an accident, don’t wait. You only have 14 days to report an injury after an accident. If you’re seriously injured and are at risk of exceeding your maximum benefits, contact us as soon as possible at CarAccidentAttorney.com, a law firm directory, and we will connect you to an attorney. If you are still determining what your insurance will cover, your attorney can gather all the information for you so you can focus on getting back on track. Accidents are stressful enough. We’re here to take the additional stress away so you can get back to your daily life.